الثلاثاء، 7 أغسطس 2012

Gold and the Euro? I thought it was Gold and the Dollar?!

Let me preface this post, by noting that I try to avoid writing about gold, since there are some many other excellent analysts out there writing about the subject. But when there is a such a strong overlap between gold and forex markets, well, I just can’t resist!

التسميات:

Gold-2012

Gold Rises as “Alternative Currency”

Gold Rises as “Alternative Currency”

Everything in forex is relative, right? Actually, it turns out this adage is wrong, as there is now a way you can short the entire forex market! I’m not talking about some innovative new financial product that you’ve never heard of, but rather something that everyone already knows about: Gold.

Before you accuse me of sounding like an infomercial, consider that while gold has been an investable commodity for quite some time, its trading pattern has changed recently, especially in the context of forex. Before, the link between gold and forexwas inverse and clear: “When the greenback strengthens…this tends to pressure gold since it reduces the need to buy as a hedge against a soft dollar. Also, a strengthening dollar makes commodities generally more expensive in other currencies.” In other words, a rising Dollar is usually accompanied by falling gold prices, and vice versa.

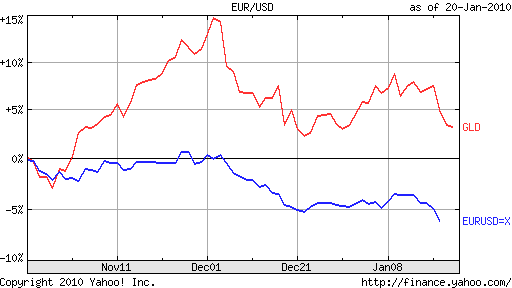

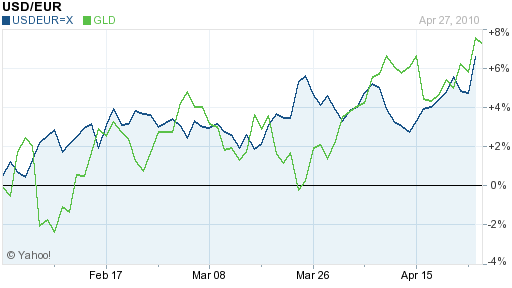

Over the course of 2010, this relationship has steadily grown weaker and weaker, and in the last month, it has almost completely broken down. To understand the rationale for such a change, one needs not to look any further than the sovereign debt crisis currently facing Greece and indirectly, the Eurozone. This crisis has affected the way that investors think about gold; while previously it was primarily viewed as an inflation hedge, now it is seen as a hedge against fiscal/financial crisis. In this regard, it has assumed the characteristics of a “safe haven” currency, much like the US Dollar.

“Gold is going to move higher regardless of what happens in the currency market, as long as there are fears of problems in Europe. People are starting to have more skepticism to a lot of these sovereign entities,” explained one analyst. At the moment, that means that the inverse correlation between the Dollar and Gold (Dollar Up = Gold Down) appears to have reversed itself, such that a rising Dollar is also accompanied by rising gold. In this case, there may be correlation (since investors are buying both gold AND the Dollar as safe haven vehicles) but there is no causationbetween the two as there was before.

At the moment, the correct interpretation is that anything is preferable to the Euro (whose sovereign debt problems are the most pressing). Thus, gold prices are rising at basically the same rate as the Euro as falling, and gold prices in local currency (EUR, CHF, GBP) terms are already at record levels. As for the future, however, many are betting that gold will distance itself from the Dollar as well, if/when the fiscal “problems” of the US escalate to the level of a Greek-style crisis. At this point, Gold will start to trade as an alternative to the entire forex market! In fact, gold contracts denominated in US Dollars have also been rising, which means that investors already perceive it as more than just an alternative to the Euro. (If this was the case, one would expect gold to appreciate in terms of Euros, but to remain constant or even fall when priced in Dollars. This clearly hasn’t happened).

As for the future, however, many are betting that gold will distance itself from the Dollar as well, if/when the fiscal “problems” of the US escalate to the level of a Greek-style crisis. At this point, Gold will start to trade as an alternative to the entire forex market! In fact, gold contracts denominated in US Dollars have also been rising, which means that investors already perceive it as more than just an alternative to the Euro. (If this was the case, one would expect gold to appreciate in terms of Euros, but to remain constant or even fall when priced in Dollars. This clearly hasn’t happened).

Admittedly, gold is outside of my expertise, so I’ll refrain from personally making any predictions. According to Deutsche Bank, “If the correlation re-establishes itself before July, either the dollar must continue to decline or investment into bullion-backed funds must pick up in order to avoid erosion in gold prices.”

Regardless of what happens, my intention here is simply to point out the emergence of this trend, for its own sake. While it doesn’t have any serious implications about the internal dynamics of forex markets, it most certainly is important insofar as it reflects what investors (forex and otherwise) are generally thinking about. In this case, it signals that concern over the ongoing sovereign debt crisis isn’t going to abate anytime soon.

التسميات:

Gold-2012

Currency War Devalues all Currencies…Except for Gold

Currency War Devalues all Currencies…Except for Gold

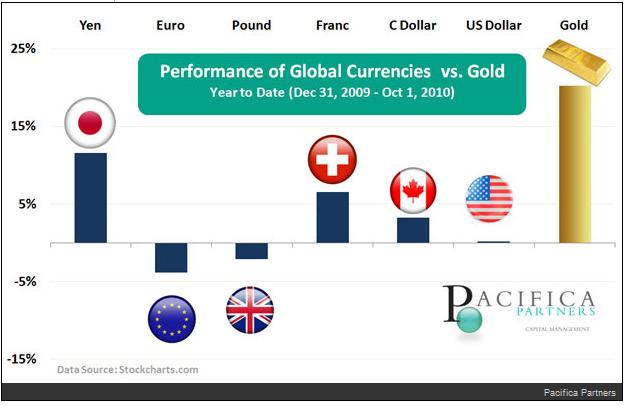

Have you ever heard currency cheerleaders rave about how unique forex is because there is never a bear market? Since all currencies trade relative to each other (when one falls, another must necessarily rise), it couldn’t be possible for the entire market to drop at once, as happens with other financial markets. The ongoing currency warmight be turning this logic on its head, as currencies embark on a collective downward spiral. Profiting in this kind of market might involve exiting it altogether, and turning to Gold.

For those of you who haven’t been following this story, a handful of the world’s largest Central Banks are now battling with each to see who can devalue their currency the fastest. [Of course, this war is being couched in euphemistic terms, but make no mistake: it is indeed a form of battle]. The principal participants are emerging market economies, which worry about the impact of rising currencies on their export sectors. However, industrialized countries have also intervened directly (namely Japan) and indirectly (US, UK).

For those of you who haven’t been following this story, a handful of the world’s largest Central Banks are now battling with each to see who can devalue their currency the fastest. [Of course, this war is being couched in euphemistic terms, but make no mistake: it is indeed a form of battle]. The principal participants are emerging market economies, which worry about the impact of rising currencies on their export sectors. However, industrialized countries have also intervened directly (namely Japan) and indirectly (US, UK).

Among the major currencies, there are only a few that continue to sit on the side-lines, including the Euro (to a certain extent), Canadian Dollar, and Australian Dollar. For as long as the currency war continues, these currencies and the handful of emerging market currencies that have forsworn intervention will be the winners (at least from the point of view of speculators that deliberately bet on them).

Then there are those that believe all currencies will suffer, and that even the currencies that are still rising are actually depreciating in real terms (due to inflation). Those who harbor such beliefs will often try to short the entire currency market, usually by betting on commodities or heavy metals, of which Gold is probably the most prominent.

The price of Gold has risen more than 20% this year (in USD terms). Its backers claim that it is the ultimate store of value (where this derives from is unclear), and defend its lack of utility and inability to accrue interest by arguing that its appreciation is more than enough of a reason to own it. When you look at the performance of gold over the last five years, you begin to wonder if maybe they have a point.

Interest in Gold as an investment has surged in the last couple years (and especially the last few months), as the currency wars have heated up and the Federal Reserve Bank contemplates an expansion of its Quantitative Easing program (dubbed” QE2″). On the one hand, the notion that the only way to defend against real currency devaluation is to own “alternative” currencies is well-founded. On the other hand, regardless of the fact that the Fed has already minted $2 Trillion in cash and that the US national debt is expanding by $1 Trillion per year, inflation in the US is low. In fact, it’s at a 50-year low, and at an annualized .9%, it’s practically non-existent. You would think that with Gold’s unending appreciation, we would be in the midst of hyperinflation, but that’s simply not the case.

In the short-term, then, there’s really not a strong fundamental basis for investing in gold. That’s not to say that it won’t continue to appreciate and that investors will continue to buy into it merely to benefit from what has become self-fulfilling appreciation. From where I’m sitting, though, there’s really no foundation for this appreciation. Consider, for example, that gold investors still have to convert their gold back into paper currency in order for it to to be “used;” otherwise, it offers no benefit to the owner except that it looks pretty (though most investors wouldn’t know, since they buy gold indirectly). Not to mention that if/when the Dollar stops depreciating, there really isn’t really a justification to buy gold as a short-term store of value.

Over the long-term, the picture is certainly more nuanced. I’m not going to explore the viability of fiat currencies here, but suffice it to say that, “Positioning for significantly higher gold prices over the long run demands a very bold strategic bet: that the global monetary system as we know it will completely break down and be replaced with a gold standard.” Regardless of the merits of this point of view, those that invest in Gold should at least understand that this is really the only justifiable reason to hold it. Those who are buying it because of the ongoing currency war will be disappointed.

التسميات:

Gold-2012

Australian Dollar Rises Despite Unwinding of Carry Trade

Australian Dollar Rises Despite Unwinding of Carry Trade

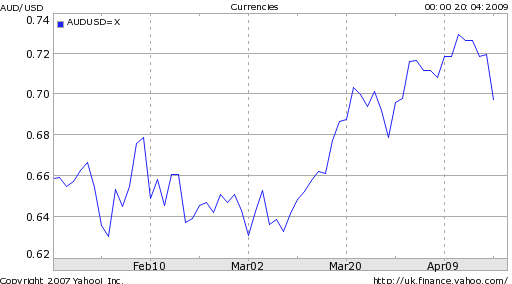

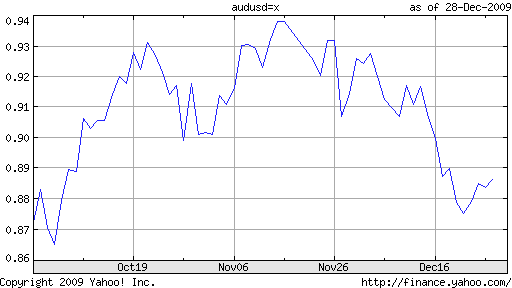

When two weeks ago the Royal Bank of Australia (RBA) cut interest rates, one would have expected the Australian Dollar to suffer proportionately. Instead, the currency continued its steady upward rise, and touched a six-month high, before falling back slightly. One surprised analyst lamented, “These types of inconsistencies can make trading forex difficult or down right frustrating at times.”

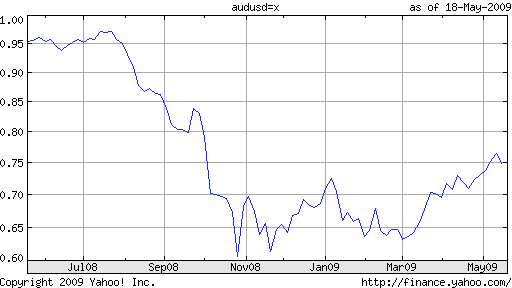

The interest rate cut marked the sixth since September, since which point the RBA has trimmed its benchmark lending rate by 425 basis points, leaving it at 3%. [See chart below courtesy of "The Fundamental Analyst."] Traders have reacted to the successive declines in yield and simultaneous pickup in risk aversion by unwinding carry trades, many of which had been long the Australian Dollar. The massive sell-off that ensued left the Aussie a long way below the level of parity with the USD, which only last year many analysts had viewed as inevitable. The most recent rate cut, in contrast, was greeted positively by traders, perhaps because they were expecting a larger (50 basis point) rate cut, but more likely because their priorities had changed. A pickup in risk aversion in recent weeks has definitely reinvigorated interest in comparatively risky currencies such as the Australian Dollar. Overall, the markets remain risk-averse, and investors are increasingly making bets in accordance with economic fundamentals, rather than yield levels. ” ‘The focus will remain on the global backdrop…Risk appetite is still fragile and the market is increasingly realizing that the recent recovery was excessive.’ ”

The most recent rate cut, in contrast, was greeted positively by traders, perhaps because they were expecting a larger (50 basis point) rate cut, but more likely because their priorities had changed. A pickup in risk aversion in recent weeks has definitely reinvigorated interest in comparatively risky currencies such as the Australian Dollar. Overall, the markets remain risk-averse, and investors are increasingly making bets in accordance with economic fundamentals, rather than yield levels. ” ‘The focus will remain on the global backdrop…Risk appetite is still fragile and the market is increasingly realizing that the recent recovery was excessive.’ ”

In the case of the Australian Dollar, traders were heartened by the RBA’s decision to lower interest rates to a 49-year low since it reflected the Bank’s commitment to dealing with the economic crisis. But at this point, the Australian economy is still in poor shape. “Prime Minister Kevin Rudd said yesterday for the first time that arecession in Australia is inevitable amid a slump in global growth that is eroding demand for natural resources from the world’s biggest shipper of coal and iron ore.”

Meanwhile, “The global economic downturn has pushed Australia’s economy into itsfirst recession since 1991, Reserve Bank of Australia Governor Glen Stevens said.” According to the minutes from the RBA’s last meeting, “Conditions in the labor market continued to soften” and “Further falls in employment and rises in unemployment were expected.” These observations should be viewed in the context of a 5.7% unemployment rate.

The near-term prognosis for the Australian economy remains quite poor, regardless of whether a recovery materializes in 2010, as forecast by economists. Accordingly, analysts expect the RBA to lower its benchmark interest rate further, probably to 2.25% or 2.5%; there is a “bias toward further modest rate cuts, although we continue to think that the RBA may well pause for a few months to assess the impact of the current round of fiscal stimulus,” offered one forecaster.

Given the lull in market activity, some commentators have turned to technical analysis. “Westpac Currency strategist Robert Rennie said their own risk measurement models are clearly flagging a bumpy period ahead for high yielding currencies. ‘Our proprietary models are…clearly telling us to watch risk sentiment and data much more closely than we have over the past six weeks.’ ” In short, traders should not become complacent as result of the Aussie’s recent rally, and should continue to monitor economic data for signs of progress and/or hiccups on the road to recovery.

التسميات:

Australian Dollar 2012

Australian, New Zealand Currencies Benefit from Risk Aversion

Australian, New Zealand Currencies Benefit from Risk Aversion

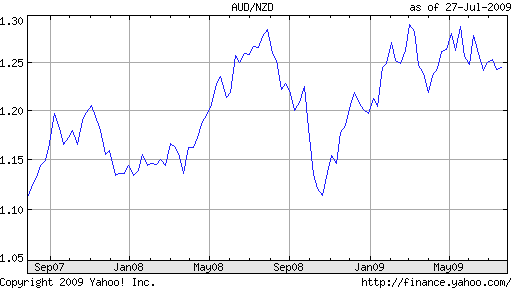

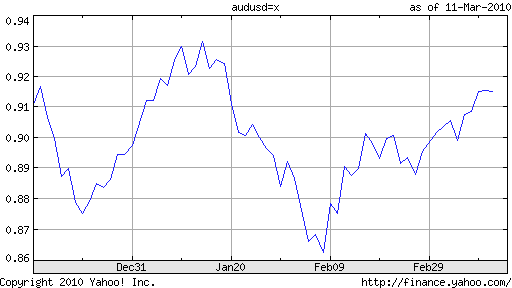

Against each other, the New Zealand Kiwi and Australian Dollar have traded in a pretty tight range for the last year (except for a “blip” in the fall of 2008). This makes sense, as both currencies rise and fall in accordance with exports and interest rates.

Against other currencies, meanwhile, both have torn upwards in the last couple months. Despite steep interest rate cuts, both currencies have maintained their interest rate advantages against other industrialized currencies. This has not gone unnoticed, and the return of the carry trade has been kind. “The current improvement in sentiment is providing an underpinning of support and while that remains the case – and that may be until midyear – the New Zealand dollar is going to remain well-supported,” said one economist.

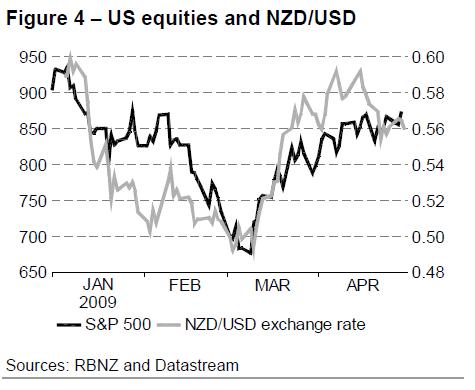

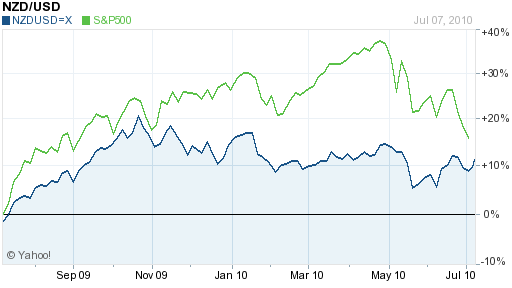

The correlation between the New Zealand Kiwi, specifically, with the US stock market has become remarkably cut-and-dried of late, which you can see from the chart below. For carry traders, therefore, it probably makes more sense to follow stock market commentary than to track New Zealand economic data. The same economist, for example, warned “that the equities rally, which has seen the broad U.S. Standard & Poor’s 500 index climb 36% from its March low after rising another 3.4% Monday to its highest since Jan. 8, may be dissipating.”

Besides, given the deteriorating economics in both countries, lower interest rates are probably inevitable: “We think this case for further cuts will be made in the second half of this year…we think it will be very difficult, no matter what the global economy is doing, for the RBA to ignore rapidly rising unemployment,” offered one analyst who predicted that rates would be cut to a “trough of 2%.” In such a scenario, the interest rate spread would still remain healthy, but perhaps not enough to offset the additional risk.

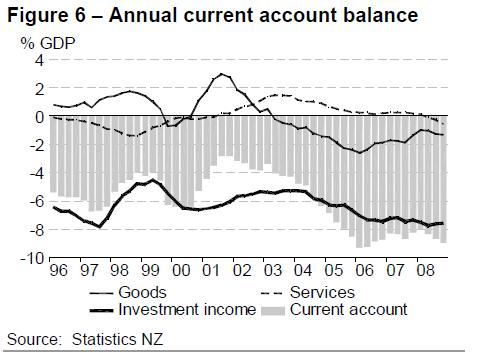

Australian home prices are falling at a rapid clip, the labor market is sagging. In New Zealand, meanwhile, a decline in sentiment and consumer spending has corresponded with a 1% contraction in GDP in the quarter ended March 31. Tourism is down, although net exports are increasing. The current account deficit continues to expand, but this is mostly a product of an investment balance – perhaps related to the carry trade. For now, forex traders remain optimistic, albeit slightly less so than before: “The difference in the number of wagers by hedge funds and other large speculators on an advance in the Australian dollar compared with those on a drop — so-called net longs— was 16,692 on April 28, compared with net longs of 17,250 a week earlier.

For now, forex traders remain optimistic, albeit slightly less so than before: “The difference in the number of wagers by hedge funds and other large speculators on an advance in the Australian dollar compared with those on a drop — so-called net longs— was 16,692 on April 28, compared with net longs of 17,250 a week earlier.

التسميات:

Australian Dollar 2012

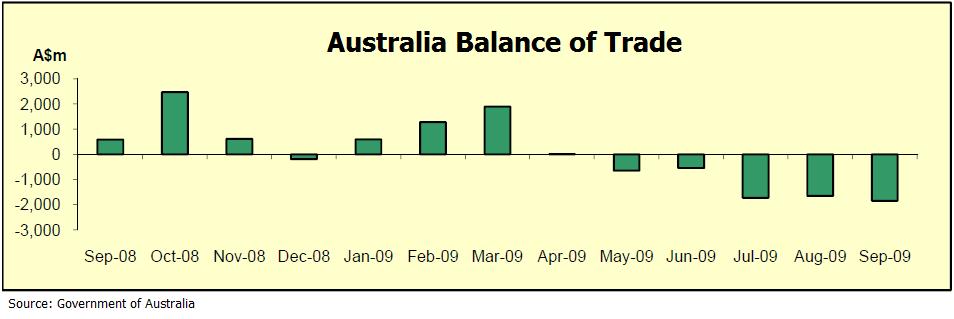

Outlook is Positive for Australia, but Less so for Australian Dollar

Outlook is Positive for Australia, but Less so for Australian Dollar

The economic outlook continues to improve for Australia. Most recently, both the government and the Central Bank released five-year growth forecasts, both of which show a modest recovery in 2010. “By 2011-12, the commodity-rich economy will again be firing on all cylinders with growth of 4.5%, well above the long-term growth rate of around 3%.”

This positive development coincided with the release of similarly upbeat economic data: “Retail sales surged 2.2 percent in March from the previous month, four times as much as economists forecast. Home-loan approvals jumped 4.9 percent, the sixth consecutive gain.” Meanwhile, unemployment shrank for the first time in months, and consumer confidence is once again rising. While the economy is forecast to shrink by .75% in the current fiscal year, this compares favorably with other industrialized countries.

The sudden turnaround can be attributed to a couple factors. First of all, the pickup in China’s economy is stimulating demand for natural resources, which had been slack for the last year. If not for simultaneously falling commodity prices, Australia might have even achieved positive economic growth for the year.

The government’s stimulus plan and spending initiatives have also played a role, although the extent cannot be measured accurately for a few months. “The government claims that measures in its budget will inject a further A$8.8 billion into the economy in 2009-10, adding to around A$50 billion in fiscal measures already announced since October 2008.”

The outlook for the Australian Dollar, meanwhile, is not so rosy. The 425 basis points in cumulative rate cuts that the Royal Bank of Australia (RBA) effected over the last year have lowered the interest rate differential with other industrialized countries. While the RBA has indicated that it will pause before cutting rates further, interest rate futures reflect the expectation that rates will be lower twelve months from now. “Economists say the RBA is open to cutting interest rates again if consumer and business confidence appear threatened, but for now it is content to let monetary and fiscal stimulus measures take hold.”

To be sure, the uptick in risk tolerance has been good for the Australian Dollar, igniting a 25% rise since March. The currency now stands at a 7-month high against the US Dollar. But the increasingly modest differential is now causing some analysts to question whether it is a reasonable risk to take, especially against the backdrop of volatility and a high correlation with global stock prices. “What’s the point of picking up a 3 percent interest-rate differential by being long Aussie and short Japan in a world where the exchange rate can move by that much in two days?” Asks One analyst rhetorically.

This same analyst is actually recommending investors to use the Australian Dollar as a funding currency, and go long on higher-yielding currencies, such as the Brazilian Real. This particular trade would have netted a respectable 5.9% return in 2009. How quickly the roles have reversed!

التسميات:

Australian Dollar 2012

Reserve Bank of Australia Could be the First to Hike Rates

Reserve Bank of Australia Could be the First to Hike Rates

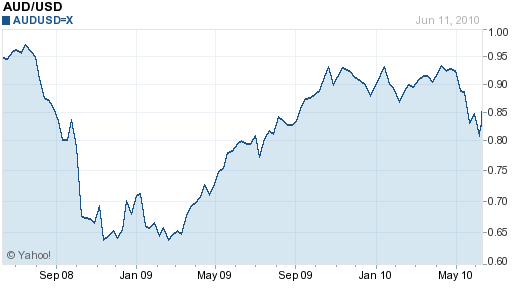

Based on the chart below, which plots the Australian Dollar against the New Zealand Dollar over the last two years, one might be tempted to conclude that the two currencies are identical for all intents and purposes. Rather than suffer the inconvenience of separately analyzing the Australian Dollar, why not just readyesterday’s post on the New Zealand Dollar, and leave it at that?

But this chart belies the fact that while the two currencies, have risen and fallen (in near lockstep) in sync with the ebb and flow of risk aversion, this could soon change. While the near-term prospects for the New Zealand economy are dubious, sentiment towards the Australian economy is more consistently optimistic. “Central bank Governor Glenn Stevens said the nation’s economic downturn may not be ‘one of the more serious’ of the post-World War II era.” In addition, “Stevens said the nation’s economy may rebound faster than the central bank had predicted six months ago onimproving confidence among consumers and businesses alike.” The latest projectionsare for a fall in .5% contraction in GDP in 2009 followed by a 1% rise in 2010.

But this chart belies the fact that while the two currencies, have risen and fallen (in near lockstep) in sync with the ebb and flow of risk aversion, this could soon change. While the near-term prospects for the New Zealand economy are dubious, sentiment towards the Australian economy is more consistently optimistic. “Central bank Governor Glenn Stevens said the nation’s economic downturn may not be ‘one of the more serious’ of the post-World War II era.” In addition, “Stevens said the nation’s economy may rebound faster than the central bank had predicted six months ago onimproving confidence among consumers and businesses alike.” The latest projectionsare for a fall in .5% contraction in GDP in 2009 followed by a 1% rise in 2010.

Meanwhile, government spending is surging: “The Australian government forecast its largest budget deficit on record of A$57.6 billion for fiscal year 2009-10, or 4.9% of GDP.” Combined with the steady recovery in commodity prices and the resumption of residential construction, this could soon trickle down through the Australian economy in the form of inflation. It’s no wonder, then, that the Reserve Bank of Australia (RBA) could begin tightening interest rates as early as December, in order to mitigate against the possibility of inflation in 2011 and 2012.

In fact, Governor Glen Stevens has been raising eyebrows with his unequivocal comments about raising rates. “I’ve never seen written down … I’ve never heard in discussion in the institution, some rule of thumb that says we wait until unemployment’s peaked before we lift the cash rate…I think it depends what else is happening, and also depends how low you went. We eased very aggressively,” he said recently. As a result, traders are betting that rates will be 1.13% higher one year from now than they are today.

This development should be of especial interest to forex traders. Australian interest rates are already the highest in the industrialized world. When you consider “the market’s expectations that the RBA is likely to be the G-10 central bank which is likely to hike first,” it goes a long way towards explaining the 18% rise in the Aussie that has taken place in 2009 alone. Compare a hypothetical 4% RBA benchmark rate to the .1% in Japan and ~0% in the US, and carry traders will start to salivate.

التسميات:

Australian Dollar 2012

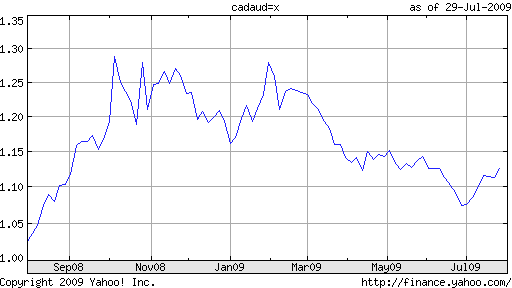

Canadian Dollar Slated to Outperform Other Commodity Currencies

Canadian Dollar Slated to Outperform Other Commodity Currencies

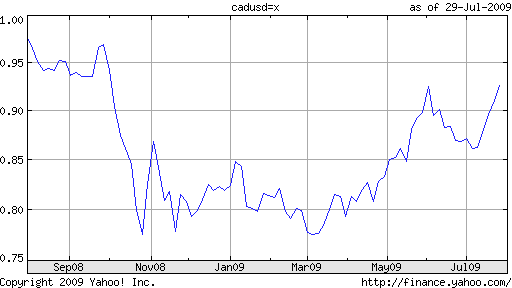

In the same vein as Monday’s and Tuesday’s posts (covering the New Zealand Dollar and Australian Dollar, respectively), I’d like to use today’s post to look at another commodity currency – the Canadian Dollar. The Loonie, it turns out, has also benefited from the a recovery in risk appetite and concomitant boom in commodity prices; it has appreciated by 7% against the USD in the last month alone, en route to a ten-month high. “All in all, with almost everything going its way these days (besides the crummy weather and the impact on tourism), a return trip to parity – last visited nearly one year ago – doesn’t seem far fetched,” chimes one optimistic analyst.

Like Australia and New Zealand, Canada’s economic fate is tied closely to commodity prices. Simply, as oil and other natural resources have inched closer to last year’s record highs, the Loonie has rebounded proportionately. “Raw materials account formore than 50 percent of Canada’s export revenue. Crude is the nation’s largest export.” Of course, this relationship works both ways. Any indication that the global economic recovery is stalling, and commodities prices would likely tumble, bringing commodity currencies down likewise.

Unlike the Australian Dollar and New Zealand Dollar, the Loonie has never really held much appeal as a carry trade currency. Even at their peak, Canadian interest rates were mediocre, from the standpoint of yield. The current rate is a measly .25%, compared to 2.5% in New Zealand and 3% in Australia. Moreover, while Australia may begin tightening as soon as the fall, “The Bank of Canada committed to keep its key policy rate at the lowest possible level until the spring of 2010,” after voting to hold rates at yesterday’s rate setting meeting. This interest differential could explain why the Aussie has outpaced the Loonie of late.

Another key difference – and potential explanation for the currencies’ recent divergence – is that Australia is considered part of the Asian economic zone, while Canada’s economic fortunes are closely aligned with those of its main trading partner, the US. China, alone, is helping to lift Australia out of recession. The US, meanwhile, is still struggling to find its feet. Hence, it is projected that Canadian GDP will contract by 2.3% in 2009, while Australian GDP may fall by a modest .5%. “When things look bad, you are more likely to sell Canada than the Australian dollar because its economy is moderated by Asian growth,” explains one analyst.

Going forward, this regional differentiation could actually work to the advantage of Canada, which is forecast to grow by an impressive 3% in 2010, compared to 1% growth in Australia. Accordingly, one analyst advises that “Investors should sell Australia’s dollar against Canada’s as a ‘relative commodity play’ because an attempt by China to reign in bank lending on concern it may be creating asset-price bubbles could slow Asian growth…’The Canadian dollar should outperform because it is much more closely linked to a recovery in the U.S.

التسميات:

Australian Dollar 2012

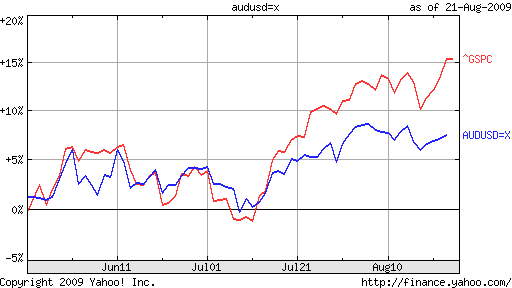

Australian Dollar Rises, Remains Closely Correlated with Stocks

Australian Dollar Rises, Remains Closely Correlated with Stocks

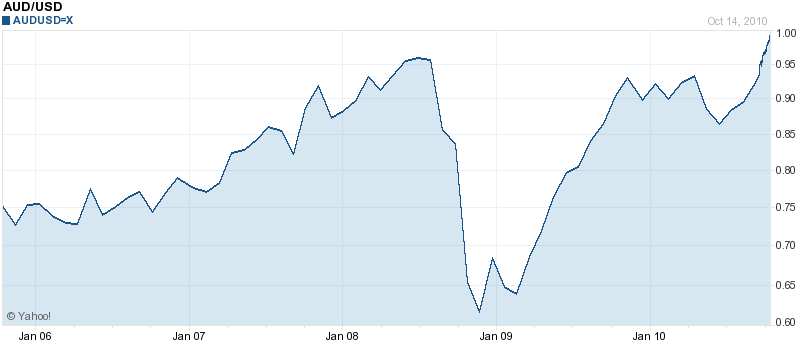

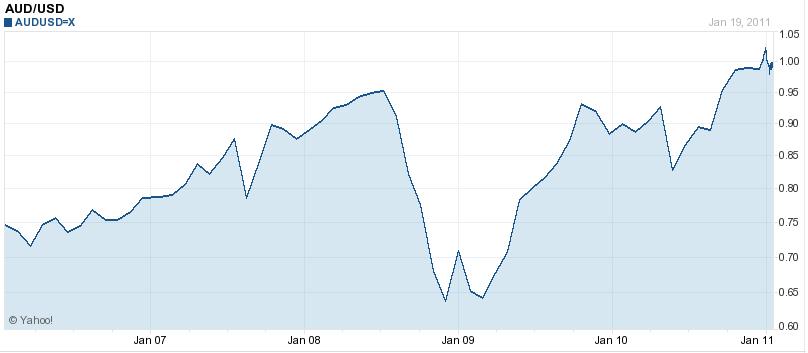

The performance of the Australian Dollar over the last six months has been nothing short of incredible: “Since the end of February, the Australian dollar has risen 29%against the U.S. currency,” and a still-impressive 18% if you backtrack to January, when the Aussie was still in free-fall.

As has been the trend in forex markets of late, the currency’s rise cannot be attributed to an improvement in fundamentals. The economic picture remains nuanced (that is putting a positive spin on it), and definitive proof of recovery has yet to emerge. “We really are trawling pretty deep to try and get any snippet of information that might have some backhanded relevance as far as Australia goes,” said one analyst.

As has been the trend in forex markets of late, the currency’s rise cannot be attributed to an improvement in fundamentals. The economic picture remains nuanced (that is putting a positive spin on it), and definitive proof of recovery has yet to emerge. “We really are trawling pretty deep to try and get any snippet of information that might have some backhanded relevance as far as Australia goes,” said one analyst.

As a result, fundamental analysts have been forced to wait for a “more precise picture about the timing [of] any Reserve Bank of Australia interest rate hike.” On this front, investors are ratcheting down their expectations of a rate hike anytime soon, as “The RBA has signaled that there’s a danger of raising rates too soon.” Futures prices reflect the expectation that rates will rise by only 37 basis points from current levels before 2010, and by 161 basis points 12 months from now.

With such economic uncertainty, investors have turned their attention elsewhere. “Nomura Chief economist Stephen Roberts said in the absence of any clues about the fundamental drivers of the currency, nearly all the cues in foreign exchange markets are being taken from equities.” Some analysts have posited a close relationship with the US stock market: “The correlation between the Aussie dollar and U.S. equity market in particular has been very strong over the past few weeks, with our analysis showing a correlation as high as 95 percent.”

For other analysts, the relationship is with the Chinese stock market. This correlation makes more sense logically, since the Australian economic recovery is largely contingent on continued growth in China and the concomitant purchases of Australian commodities. “Currency markets will be watching the Shanghai share market, which has been a pretty big influence on the Aussie recently,” summarized one analyst. A reporter for the WSJ tried to spell it out even more clearly in an article entitled, “Australian Dollar Up Late, Closely Tied To Chinese Stocks.”

Unfortunately, the correlation with (Chinese) stocks runs both ways. When the Chinese stock market tanks – often for inexplicable reasons – as it has for the last three weeks, the Australian Dollar follows suit. Another analyst is more blunt: “The story for the Australian dollar and other risk- and growth-oriented currencies is similar to the share markets. They’ve had a great run and are probably due a bit of a pullback.

التسميات:

Australian Dollar 2012

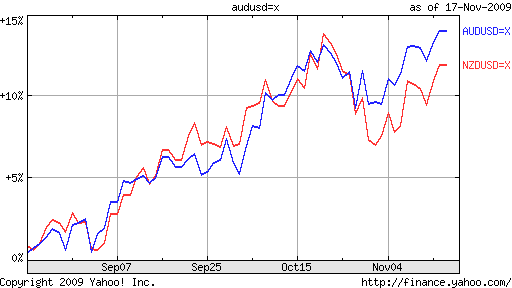

Kiwi and Aussie Diverge, then Re-Unite

Over the last few months, the New Zealand Dollar and Australian Dollar have largely moved in

Kiwi and Aussie Diverge, then Re-Unite

tandem (see chart below). When the Reserve Bank of Australia raised its benchmark interest rate earlier this month, it shocked the markets and the Aussie shot up, while the Kiwi remained fixed in place. Many observers predicted that such was the beginning of a divergence in the two currencies. Less than one week later, however, the New Zealand Dollar hitched itself back to the Australian Dollar, and the two currencies have since traded in lockstep.

Investors have long tended to view the currencies (and economies) of New Zealand and Australia as one. Both economies boast large export sectors, and for much of the last decade, high interest rates. Given that the carry trade has been (and continues to be) one of the largest forces in forex markets, it makes sense that the Kiwi and Aussie would be grouped together.

Both these superfical similarities mask substantive differences, which have only become more accentuated as a result of the global economic crisis. Alan Bollard, Governor of the Bank of New Zealand summarized this disparity as follows: “Australia has avoided negative growth, and its prospects are driven by strong terms of trade, vast mineral deposits, the Chinese market, and rapid population growth. New Zealand has had a recession, and the pick-up is slower and more vulnerable – a difference financial markets do not appear to appreciate.”

While both economies are currently experiencing negative trade imbalances, New Zealand’s deficit was 5.9% at last count, while Australia’s is closer to 2%. Given that Australia’s (energy and commodity) exports have surged by nearly 30% in the last few months, while New Zealand exports are stagnating, this discrepancy could widen in the coming months. Investment is also surging in Australia, as “The value of advanced resource projects — those that are either committed or under construction — jumped 41% to a record 112.46 billion Australian dollars (US$104.03 billion) in the six months to the end of October.” And of course, the most obvious point of differentiation is between the two economies’ respective benchmark interest rates. Thanks to the aforementioned rate hike, Australian rates stand at 3.5%, exactly 1% higher than comparable New Zealand rates. Many analysts point to Australia’s improving fundamentals (higher rates, positive GDP growth, booming investment in the energy sector, increasing exports) as the basis for the strong appreciation in the Australian Dollar. Given that the New Zealand Dollar has kept pace with the Australian Dollar (it is in fact the world’s best performing “major currency” over the last six months), this kind of analysis seems dubious, if not completely irrelevant.

Many analysts point to Australia’s improving fundamentals (higher rates, positive GDP growth, booming investment in the energy sector, increasing exports) as the basis for the strong appreciation in the Australian Dollar. Given that the New Zealand Dollar has kept pace with the Australian Dollar (it is in fact the world’s best performing “major currency” over the last six months), this kind of analysis seems dubious, if not completely irrelevant.

It should be clear to most observers that the carry trade is dominating activity in the forex markets. Carry traders, relatively speaking, are undiscriminating, with the main factor of importance being interest rate differentials. Despite the fact that New Zealand interest rates are only 2.5% higher than US rates (and actually less than Australian rates) – hardly enough to compensate investors for volatility risk – the markets are awash in liquidity, and investors are once again chasing yield wherever they can find it.

One analyst offered a frank summary of this phenomenon: “It’s all about the carry trade. The Fed can’t do anything; certainly they can’t raise rates and the market knows that, and is exploiting it for the carry trade, borrowing in U.S. dollars, and the Kiwi is a beneficiary of that…That’s the only game in town. You can forget most economic data, it’s all about…the Fed.” Given that Australian rates are projected to rise faster and higher than New Zealand rates (beginning as soon as December 1), it’s conceivable that the Aussie will outpace the Kiwi. At the same time, the fact that US interest rates will likely remain low for a while means that both currencies will continue to benefit in the short term.

التسميات:

Australian Dollar 2012

Pause in Rate Hikes Threatens AUD

Pause in Rate Hikes Threatens AUD

In October, the Reserve Bank of Australia (RBA) became the first industrialized Central Bank to raise interest rates. It followed this up with two additional hikes in November and December, bringing its benchmark rate to the current level of 3.75%, by far the highest among major currencies.

This series of rate hikes caught (forex) markets completely off guard, and investors moved quickly to price the changes into securities and exchange rates. The Australian Dollar initially spiked more than 7% following the first rate hike, bringing its total appreciation in 2009 to 32%- enough to earn it the distinction as the second-best performing currency, after the Brazilian Real. Beginning in November, however, concerns began to build that perhaps traders had gotten ahead of themselves, and the AUD has been in freefall since then. Investors now fear that the RBA may have acted too hastily in hiking rates so soon and so fast. By its own admission, the RBA raised rates only after much deliberation: “The rate adjustment ‘would not be intended to slow demand compared with the current forecast path, but aimed simply at keeping the stance of policy appropriate for improving economic conditions,’ ” according to its own minutes. Since the recession was ultimately so mild (some would say ‘non-existent’) in Australia, however, the RBA ultimately decided that (pre-emptive) rate hikes were in order.

Investors now fear that the RBA may have acted too hastily in hiking rates so soon and so fast. By its own admission, the RBA raised rates only after much deliberation: “The rate adjustment ‘would not be intended to slow demand compared with the current forecast path, but aimed simply at keeping the stance of policy appropriate for improving economic conditions,’ ” according to its own minutes. Since the recession was ultimately so mild (some would say ‘non-existent’) in Australia, however, the RBA ultimately decided that (pre-emptive) rate hikes were in order.

Now, interest rates are back in the “normal range,” according to a deputy governor from the RBA. In other words, the current rate is perceived as neither promoting nor hindering aggregate demand, which means it may not need to be tweaked much more in the near-term. In addition, there is growing concern that further rate hikes could trigger a cycle of deleveraging, because of the high debt burdens that plague Australian households and businesses. Household debt already exceeds 100% of GDP, which is even higher than in the US.

Besides, financial institutions are raising their own lending rates by wider margins than the benchmark rate hikes, so there is less impetus for the RBA to act further. Investors appear to have come to terms with this, as futures markets now reflect a 45% probability of another interest rate hike at the next RBA meeting, in February. This is down from 67% only last week.

If you’re wondering whether the RBA could be influenced by the lofty Australian Dollar when conducting monetary policy, it’s conceivable but not probable. It has already acknowledged that the carry trade is generally “back in vogue” and specifically targeting its very own Aussie, but that “As on earlier occasions, the economy has proven to be resilient to these [forex] swings.” If it turns out that the markets truly overestimated the pace of recovery (and by extension, interest rate hikes) in Australia, then the RBA won’t even have to worry about whether the economy can withstand further appreciation, since the AUD would probably remain fixed at current levels.

التسميات:

Australian Dollar 2012

Australia Hikes Rates; How about the Carry Trade?

Australia Hikes Rates; How about the Carry Trade?

Following up on my last post, I want to use this post to write about the long side of the carry trade- specifically the Australian Dollar. The Bank of International Settlements (BIS) observed in a recent report that, “The role of short-term interest rate differentials in both the deprecations and their reversal has grown over time.” When you consider that the benchmark interest rate in Australia is now 4% and that interest rates in every other industrialized country (including Japan) are close to 0%, it’s not hard to connect the dots.

Earlier this month, the Reserve Bank of Australia (RBA) raised the benchmark by .25% for the fourth time since it began tightening. In an accompanying press release, the RBA stated that “The board judges that with growth likely to be close to trend and inflation close to target over the coming year, it is appropriate for interest rates to be closer to average. Today’s decision is a further step in that process. It’s worth noting that the Australian Dollar barely budged, because investors had expected the move. The larger question was, and still is, the ultimate extent of RBA rate hikes and how soon it will get there.

Glen Stevens, Governor of the RBA, has himself indicated that ”rates are still 50 to 100 basis points, or hundredths of a percentage point, below normal.” If you do that math, that means that the RBA will hike rates to 4.5-5% before stopping. Other more bullish analysts think 5-6% is a more realistic expectation because it is closer to the long-term average of Australian rate hikes.

As to when the benchmark will reach that point, it’s anyone’s guess. Going forward, analysts have pegged the liklihood of an April rate hike at 40%. Said one analyst, “It’s now a line-ball call; indeed, if you put a gun to my head . . . I’d guess that the RBA is going to hike again by 25 basis points in April.” Still, most think that the RBA won’t hike again until May. Added another analyst, “They are not indicating any urgency. We think they will go again in a couple of months. It could be three months, it could be two, our formal view is two, that may depend on how the inflation numbers look.” It’s too early to project when the next next (after the next one) hike will take place, because it depends on the timing of the first one.

At this point, most Australian economic data is trending steadily in the right direction. “Australia’s economy is starting a new upswing…Unemployment fell to 5.3% in January, not far above levels considered full employment for the economy…A rebound in construction and an investment splurge in the mining sector are expected to restore growth in the economy back to historic averages by the end of 2010. The RBA has indicated it expects inflation to remain within its 2%-3% target band.” Without drilling too deeply into any of the other numbers, there’s very little reason to doubt that the Australian economic recovery is genuine, which reinforces the notion that it is only a question of when – not if – the RBA further hikes rates.

In fact, the picture surrounding the Australian Dollar is almost a mirror image of the Japanese Yen. While the Yen looks destined to fall irrespective of the carry trade, the Australian Dollar looks destined to fall. While further monetary easing in Japan will give the Yen a second life as a funding currency, higher rates in Australia will once again make it a popular long currency. In short, “With commodity prices likely to remain strong and the spread between Australian and US interest rates likely to widen further its only a matter of time before the Australian dollar breaches parityagainst the US dollar.”

In fact, the Australian Dollar just touched a 13-year high against the Euro – though that is as much due to the Greek debt crisis and Euro problems as it is with Aussie strength. Meanwhile, the Australian Dollar has zig-zagged against the US Dollar, and is now in a rising trend following a recovery in risk sentiment. Whether it sustains this momentum depends largely on whether the RBA hikes rates next month.

التسميات:

Australian Dollar 2012

Why is the Loonie Beating the Aussie?

It sounds like the beginning to a bad joke, right? But seriously, why is the Canadian Dollar (aka Loonie) beating the Australian Dollar (AUD) when the two currencies are placed head-to-head?

The currency markets tend to be very Dollar-Centric, in that they tend to view most currencies relative to the US Dollar (and to a lesser extent, the Euro), rather than to each other. When it comes to the Aussie and Loonie, then, traders at the moment seem content to see them as relatively strong, since both are appreciating against the Dollar. After all, the AUD/CAD pair accounts for only a small fraction of overall trading activity, which means that liquidity is lower and spreads are higher. Why bother?

But this ignores the fact that an important battle is currently being waged by the two currencies not only against the Dollar, but also against the other. It’s not as if the AUD/CAD rate is determined solely based on triangular arbitrage (i.e. indirectly from the AUD/USD and USD/CAD). On the contrary, there are unique factors which determine this exchange rate irrespective of others, as well as specific financial instruments.

But enough with the palavering!Let’s try to understand the idea of parity as it exists between the Loonie and Aussie, and not relative to the Greenback. I like to begin any analysis by looking at a chart. But as with any financial chart, a different time period changes the whole picture. In this case, the 1-year chart shows the Australian Dollar gaining in 2009 (in fact it was the highest performer last year among all of the majors) from the lows of the credit crunch, but retreating in 2010 away from parity. It is this latter trend that I want to elucidate here.

On paper, the Aussie would seem to be the clear favorite. As a result of this month’s interest rate hike by the RBA, the benchmark Australian rate (4%) is now a healthy 3.5% higher than its Canadian counterpart (.5%). This should favor the Aussie among carry traders looking for the highest yield differentials. In addition, the Australian Dollar accounts for a higher portion (6.7% versus 4.2%) of forex turnover than the Canadian Dollar, according to the most recent data, which means that the AUD wins the liquidity battle as well. Meanwhile, Australia’s public debt is near the low end among developed countries, at almost 15% of GDP. After a record 2009 budget deficit, Canada’s public debt is close to 80% of GDP and is among the highest the world. Finally, Australia’s economy was one of the first to emerge from recession (some say it never even officially entered recession), certainly before Canada.

But all of this is in the past. “Canada is on course to be the first Group of Seven nation to erase its budget gap after the global financial crisis.” [Australia should have won this distinction, but alas, it's not a member of the G7]. In 2009 Q4 (the most recent for which data is available), Canada’s economy grew at 5%, compared to 2.7% in Australia. While the US economy – Canada’s largest trade partner – is accelerating, China – Australia’s most important trade partner – is attempting to slow down.

While both the Aussie and Loonie are thought of as commodity currencies, the Loonie is currently benefiting from higher oil prices while the Aussie could suffer from peaking coal and iron ore prices. Volatility (as implied by options contracts) is lower for the Loonie, and this is just as significant as the interest rate differential, when it comes to the carry trade. When you consider finally that “Canada’s financial system was named the soundest in the world for two consecutive years by the Geneva-based World Economic Forum,” its banks are all financially sound, and the attention garnered by the Vancouver Olympics, it’s no wonder that the Loonie is now edging ahead.

Over the last five years, the two currencies have been pretty stable against each other. [Against a basket of other currencies, the Loonie is ahead, with a 20% total appreciation compared to the Aussie's 17% rise]. Thus, the current ebb could be a necessary correction. While analysts like to see things in terms of important psychological milestones, there’s no real reason why the two currencies should trade at 1:1 (parity), and the equilibrium value could very well be below the current level.

This is evidently how the markets feel, as the Aussie just slipped below its 200-day moving average against the Loonie for the first time since 2008. In addition, “Investors paid the largest premium in almost a year last month for Australian dollar put options versus the Loonie. The premium of contracts granting the right to sell the Aussie versus the Canadian currency in one week over those for buying increased on February 8 to 1.18 percentage points, the biggest since April 2009.” After all, the Aussie’s appreciation in 2009 was the highest in 15 years. Perhaps it’s only natural that all else being equal, it should fall a bit in 2012.

التسميات:

Australian Dollar 2012

Risk Aversion Hits Australian Dollar

Risk Aversion Hits Australian Dollar

These days, I feel like you could take that title and substitute pretty much any currency for the Australian Dollar. Let’s face it- the EU sovereign debt crisis has hit a number of currencies extremely hard, as investors have fled anything and everything risky, in favor of the US Dollar, Swiss Franc, Japanese Yen, and Gold.

Still, the Australian Dollar merits special attention, because in the forex markets, it has come to be a symbol of risk-taking. For veritable years, every credit expansion and economic boom has been accompanied by a surge in the value of the Aussie, and 2009 was no exception. As the global economy recovered and risk aversion ebbed, the Australian Dollar rose by more than 40% against the USD. It has been helped in its upward course by Chinese demand for its natural resources and strong interest rates, especially compared to the rest of the industrialized world.

That the Australian Dollar has already fallen 14% (from peak to trough) against the US Dollar over the last month is less due to economic and monetary factors, however, and more the result of an ebb in risk-taking. “The Australian dollar is considered a barometer of global risk appetite. Its fall reflects the quick change in mood, as Europe’s debt problems and China’s monetary tightening plans cloud expectations for the global economic growth,” summarized one analyst.

Specifically, investors are growing increasingly nervous about the viability of the carry trade, of which the Australian Dollar has been one of the primary beneficiaries. Uncertainty surrounding the fiscal problems of the Eurozone has catalyzed a spike in volatility, and investors have responded by rapidly unwinding their carry trade positions. Ironically, this caused a temporary upswing in the Euro, at the expense of the Aussie: ” ‘The euro rally isn’t that people like the euro. Investors have decided they want out of risk.’ The way to remove that risk from portfolios is to pay back the euro loans by selling the Australian dollar.”

From another standpoint, the yield advantage associated with holding Australian Dollars is no longer enough to compensate investors for the added risk. After adjusting for inflation, real interest rates in Australia are only about 2.5% (the nominal benchmark rate is 4.5%). This is still 2.5% higher than the benchmark US Federal Funds Rate, but not very attractive if you consider that the Australian Dollar has fallen by more than 2.5% against the US Dollar in several individual trading sessions in May. Moreover, the Reserve Bank of Australia (RBA) is signalling a pause in its rate hikes. If futures contracts are any indication, the Fed and the ECB will raise their respective interest rates before the RBA moves again.

Going forward, the consensus is that a sustainable level for the Australian Dollar based on current fundamentals is probably around .75 AUD/USD. However, the Aussie rallied 5% against the US Dollar last week, which suggests that investors still aren’t ready to give up completely: ” ‘The environment is not yet ripe to get truly bearish on the Australian dollar,’ said Commonwealth Bank Strategist Richard Grace. There are positives on the horizon, namely a better outlook for the U.S. and a calming of the Greek crisis, he said. He’s forecasting a return to $0.87.” Personally, I could see the Aussie going either way. Parity probably isn’t on the table anymore, but virtually everything else still is.

التسميات:

Australian Dollar 2012

New Zealand Dollar Thriving in Obscurity

New Zealand Dollar Thriving in Obscurity

It’s understandable that forex investors basically ignore New Zealand. Its economy is around 10% the size of its neighbor Australia, its currency is less liquid, and spreads are higher. Given that its performance closely tracks the Australian Dollar, meanwhile, why pay it any attention?

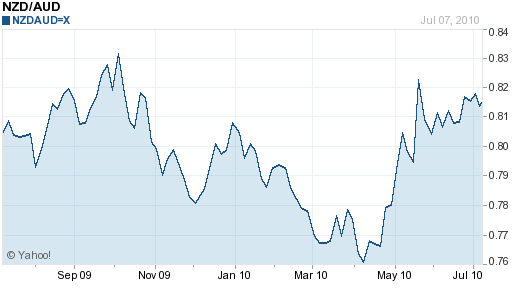

To be sure, the new currencies from Down Under trade in virtual lockstep, having strayed by only a few cents in either direction from their trading mean over the last year. Since the beginning of May, however, the Kiwi has staged an impressive rally, rising 8% against the Aussie in a matter of weeks. Perhaps, there is something worth analyzing after all!

According to most analysts, the sudden rise is largely a product of risk-appetite. Specifically, as the EU sovereign debt crisis stalls, investors are relaxing, and gradually moving capital back into growth currencies, like the New Zealand Dollar. In fact, the Kiwi recently rose to a one-month high on the same day that Spain successfully completed a bond auction.

For proof of this phenomenon, one need look no further than the close relationship between the NZD/USD rate and US stocks, as proxied by the S&P 500. You can see from the chart below that they have largely tracked each other over the last 12 months. This relationship seems to have intensified over the last few weeks, as the New Zealand Dollar sometimes takes its cues directly from releases of US economic data.

However, New Zealand economic fundamentals are also playing a role, perhaps even the dominant role. According to one analyst, “The NZ dollar had now recovered nearly all its losses of late May…Domestic fundamentals had contributed relatively more to the NZ dollar’s recent recovery than had the mild improvement in the global backdrop.” Unlike Australia, which has been racked by political disruptions and concerns over an economic slowdown by its largest trade partner (China), New Zealand continues to coast at a healthy pace.

Moody’s forecasts that New Zealand’s economy will expand by 2.4% in 2010, and “assuming a healthy global economy, New Zealand’s recovery should evolve into a self-sustaining expansion during 2011 and 2012.” This should set the stage for near-term rate hikes, beginning with an expected 25 basis point hike on July 29. Analysts project that the benchmark rate will reach 3.75% by the end of 2010, and 5% in 2011. Widening interest rate differentials, combined with the ongoing recovery in risk appetite, could turn the Kiwi into a popular carry trade currency.

Given that the Central Bank of Australia is also projected to further hike rates, it seems the Aussie will join the Kiwi in its upward march, and that the two currencies will continue to trade in lockstep. Options traders might try to construct a low volatility strategy, such as a short straddle or selling covered calls against the pair. For currency traders that prefer the Aussie, meanwhile, the New Zealand Dollar could serve as an attractive hedge.

Then again, it’s possible that both currencies could fade, especially if the EU debt crisis intensifies, and/or the global economic recovery stalls. In short, “The near-term outlook is…uncertain due to prevailing risk aversion that may weigh on the commodity currency universe.

التسميات:

Australian Dollar 2012

Australia Dollar Ebbs and Flows with Risk

Australia Dollar Ebbs and Flows with Risk

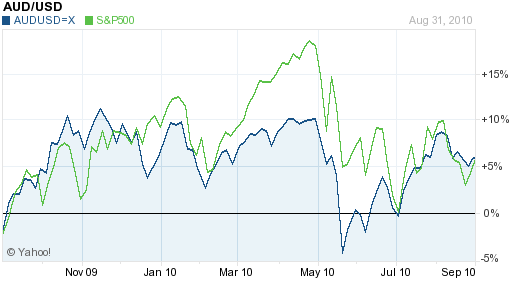

If you chart the course of the Australian Dollar over the last twelve months alongside the S&P 500, the overlap is jarring. You can see from the chart below that the two lines zig and zag in almost perfect unison. It would seem that there was a slight break in the second quarter of 2010, but even this is an illusion, since the Aussie and the S&P continued to rise and fall in the same patterns over that time period, differing only in degree of fluctuation.

Since the S&P 500 is a pretty good proxy for risk it can be said that the Australian Dollar is a manifestation of investor risk appetite. When risk aversion was high, the S&P and the Aussie were low. When risk tolerance picked up, they rose. It’s funny how this came to be. It is probably best seen as a vestige from the credit crisis, whereby investors evenly divided assets into two classes: risky and safe. When you look at the performance of the Australian Dollar, it is pretty clear as to which side of the dividing line it was placed.

This is probably fair, since the Australian Dollar is a growth currency. According to the just-released Bank of International Settlements (BIS) Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity, the Australian Dollar is now the world’s fifth most traded currency (behind only the G4: Dollar, Euro, Yen, & Pound), having usurped that position from the Swiss Franc. In 2010, it accounted for 7.6% (out of a total of 200%) of all trading volume, primarily as a result of trading in the USD/AUD currency pair, which was the fourth most popular in forex.

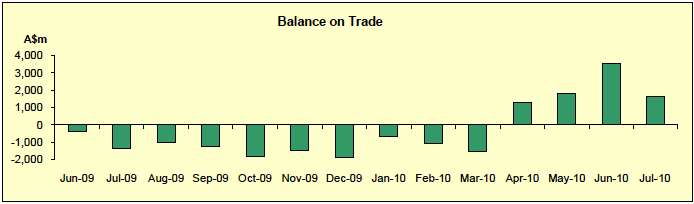

Investors have come to see the Australian Dollar in somewhat contradictory terms. It is both stable and liquid, but its economy is unpredictable and inflation is usually above average. The current economic situation was strong, with GDP growth projected to exceed 3% in 2010. Its benchmark interest rate (4.5%) is the highest in the industrialized world, and may touch 5% before the year is over. On the other hand, its political situation is currently uncertain, thanks to an election that produced a hung Parliament and the recent resignation of its Prime Minster. In addition, while its trade balance is currently in surplus, it fell in July thanks todecreased demand from China. Analysts wonder whether it isn’t entirely dependent on China (directly via exports and indirectly via high commodity prices) to generate positive GDP growth.

Ultimately, investors don’t care about any of this. They care only whether the global economy is stable and whether another financial/credit/economic crisis is likely to occur. Even though any such crisis will probably spare Australia, the Aussie is punished by even the whiff of crisis because Australia is perceived as being riskier to invest than the US, for example. “The Australian dollar is going to stay heavy. Markets don’t like uncertainty,” summarized JP Morgan.

Sadly, it’s currently not worth parsing the nuances of trade statistics and monetary policy, because it has no bearing on the Aussie, though at least this makes my job easier. For the time being, the Australian Dollar will tick up if it looks like the global economy (principally the US) will avoid a double-dip recession. Otherwise, it is in for the same rough stretch as the S&P.

التسميات:

Australian Dollar 2012

Betting on China Via Australia

Betting on China Via Australia

There are plenty of investors that think betting on China is as close to a sure thing as there could possibly be. The only problem is that investing directly in China’s economic freight train is complicated, opaque, and sometimes impossible. The Chinese government maintains strict capital controls, prohibits foreigners from directly owning certain types of investment vehicles, and prevents the Chinese Yuan from appreciating too quickly, if at all. For those that want exposure to China without all of the attendant risks, there is a neat alternative: the Australian Dollar (AUD).

Those of you that regularly read my posts and/or follow the forex markets closely should be aware of the many correlations that exist between currencies and other financial markets, as well as between currencies. In this case, there would appear to be a strong correlation between Chinese economic growth and the Australian Dollar. If the Chinese Yuan were able to float freely, it might rise and fall in line with the AUD. Since the Yuan is fixed to the US Dollar, however, we must look for a more roundabout connection. HSBC research analysts used Chinese electricity consumption as a proxy for Chinese economic activity (why they didn’t just use GDP is still unclear to me), and discovered that it fluctuated in perfect accordance with the Australian Dollar.

Before I get ahead of myself, I want to explain why one would even posit a connection between China and the Aussie in the first place. There are actually a few reasons. First, Australia is economically part of Asia: “Today, 43 per cent ofAustralia’s total merchandise trade is with north Asia. A further 15 per cent is with Southeast Asia.” Second, Australia’s economy is driven by the extraction and sale of natural resources, of which China is a major buyer and investor: “In 2008-9, China was the biggest investor in the key resource sector with $26.3bn involvements approved, 30 per cent of the total.” Third, Chinese demand has come to dictate the prices of many such resources, causing them to rise continuously. Thus, Australia’s natural resource exports to countries other than China still draw strength (via high commodity prices) from Chinese demand.

As one analyst summarized, “China is buying raw materials from Australia in leaps and bounds, and that’s what’s driving that currency’s growth.” Sounds like an Open and Shut case. In fact, this presumed correlation has become so entrenched that any indication that China is trying to cool its own economy almost always prompts a reaction in the Aussie. To be sure, warnings that China’s annual legislative conference (scheduled for October 17) would produce a consensus call for a tightening of economic policy have made some forecasters more conservative. Still, as long as the Chinese economy remains strong, the Australian Dollar should follow.

It’s worth pointing out that the correlation between the Aussie and the Chinese economy doesn’t exist in a vacuum. For example, the Australian Dollar has also closely mirrored the S&P 500 over the last decade, which suggests that global economic growth (and higher commodity prices) are as much of a factor in the Aussie’s appreciation as is Chinese economic activity. The Aussie is also vulnerable to a decline in risk appetite, like the kind that took place during the financial crisis and flared up again as a result of the EU Sovereign debt crisis. During such periods, Chinese demand for commodities becomes irrelevant.

On the other hand, part of the reason the Australian Dollar has surged 10% since September and 20% since June is because other countries’ Central Banks (such as China) have increased their interventions on behalf of their respective currencies. Australia is one of a handful of countries whose Central Bank not only hasn’t actively tried to depress its currency, but whose monetary policy (via interest rate hikes) actually invites further appreciation. As the Aussie closes in on parity and Australian exporters and tourism operators become more vocal about the impact on business, however, the Reserve Bank of Australia (RBA) might be forced to act.

التسميات:

Australian Dollar 2012

Aussie May Have Peaked in 2012

Aussie May Have Peaked in 2012

When offering forecasts for 2011, I feel like I can just take the stock phrase “______ is due for a correction” and apply it to one of any number of currencies. But let’s face it: 2009 – 2010 were banner years for commodity currencies and emerging market currencies, as investors shook off the credit crisis and piled back into risky assets. As a result, a widespread correction might be just what the doctor ordered, starting with the Australian Dollar.

By any measure, the Aussie was a standout in the forex markets in 2010. After getting off to a slow start, it rose a whopping 25% against the US Dollar, and breached parity (1:1) for the first time since it was launched in 1983. Just like with every currency, there is a narrative that can be used to explain the Aussie’s rise. High interest rates. Strong economic growth. In the end, though, it comes down to commodities. If you chart the recent performance of the Australian Dollar, you will notice that it almost perfectly tracks the movement of commodities prices. (In fact, if not for the fact that commodities are more volatile than currencies, the two charts might line up perfectly!) By no coincidence, the structure of Australia’s economy is increasingly tilted towards the extraction, processing, and export of raw materials. As prices for these commodities have risen (tripling over the last decade), so, too, has demand for Australian currency.

If you chart the recent performance of the Australian Dollar, you will notice that it almost perfectly tracks the movement of commodities prices. (In fact, if not for the fact that commodities are more volatile than currencies, the two charts might line up perfectly!) By no coincidence, the structure of Australia’s economy is increasingly tilted towards the extraction, processing, and export of raw materials. As prices for these commodities have risen (tripling over the last decade), so, too, has demand for Australian currency.

To take this line of reasoning one step further, China represents the primary market for Australian commodities. “China, according to the Reserve Bank of Australia, accounts for around two-thirds of world iron ore demand, about one-third of aluminium ore demand and more than 45 per cent of global demand for coal.” In other words, saying that the Australian Dollar closely mirrors commodities prices is really an indirect way of saying that the Australian Dollar is simply a function of Chinese economic growth.

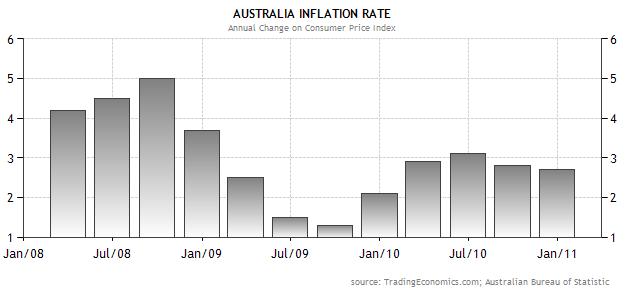

Going forward, there are many analysts who are trying to forecast the Aussie based on interest rates and risk appetite and the impact of this fall’s catastrophic floods. (For the record, the former will gradually rise from the current level of 4.75%, and the latter will shave .5% or so from Australian GDP, while it’s unclear to what extent the EU sovereign debt crisis will curtail risk appetite…but this is all beside the point.) What we should be focusing on is commodity prices, and more importantly, the Chinese economy.

Chinese GDP probably grew 10% in 2010, exceeding both economists’ forecasts and the goals of Chinese policymakers. The concern, however, is that the Chinese economic steamer is now powering forward at an uncontrollable speed, leaving asset bubbles and inflation in its wake. The People’s Bank of China has begun to cautiously lift interest rates, raise reserve ratios, and tighten the supply of credit. This should gradually trickle down in the form of price stability and more sustainable growth.

Some analysts don’t expect the Chinese economic juggernaut to slow down: “Whilethere is always a chance of a slowdown in China, the authorities there have proved remarkably adept at getting that economy going again should it falter.” But remember- the issue is not whether its economy will suddenly falter, but whether those same “authorities” will deliberately engineer a slowdown, in order to prevent consumer prices and asset prices from rising inexorably. The impact on the Aussie would be devastating. “A recent study by Fitch concluded that if China’s growth falls to 5pc this year rather than the expected 10pc, global commodity prices would plunge by as much as 20pc.” [According to that same article, the number of hedge funds that is betting on a Chinese economic slowdown is increasing dramatically]. If the Aussie maintains its close correlation with commodity prices, then we can expect it to decline proportionately if/when China’s economy finally slows down.

The impact on the Aussie would be devastating. “A recent study by Fitch concluded that if China’s growth falls to 5pc this year rather than the expected 10pc, global commodity prices would plunge by as much as 20pc.” [According to that same article, the number of hedge funds that is betting on a Chinese economic slowdown is increasing dramatically]. If the Aussie maintains its close correlation with commodity prices, then we can expect it to decline proportionately if/when China’s economy finally slows down.

التسميات:

Australian Dollar 2012

Can the Australian Dollar Hold on to Record Gains?

Can the Australian Dollar Hold on to Record Gains?

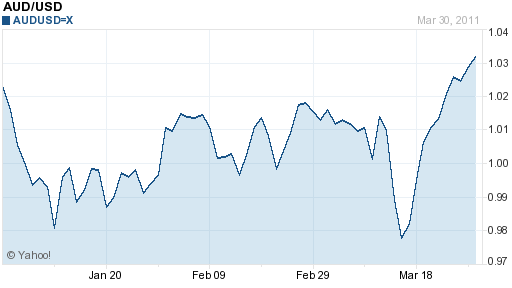

The volatility of the last couple weeks has manifested itself in some unbelievable outcomes. In this post, I want to focus specifically on the Australian Dollar. When the Japanese disasters struck, the Aussie immediately tanked, as investors jettisoned risk and moved towards safe haven currencies. Only days later, it inexplicably rose 5%, en route to parity and a 28-year high against the US Dollar. The question is: will the Aussie hold on to these gains, or will it return to earth as soon as the markets come to terms with the misalignment with fundamentals?

The Australian Dollar remains buoyant largely because of interest rate differentials. Basically, Australia boasts the highest benchmark interest rates (4.75%) in the industrialized world, and investors are betting that it will rise further, perhaps to 5.5% by the end of 2011 and even higher in 2012. Given that the other G7 Central Banks probably won’t hike for a couple more quarters – and even then, rate hikes will be gradual and restrained – it’s only natural that yield seekers are flocking to the Aussie.

The Australian Dollar remains buoyant largely because of interest rate differentials. Basically, Australia boasts the highest benchmark interest rates (4.75%) in the industrialized world, and investors are betting that it will rise further, perhaps to 5.5% by the end of 2011 and even higher in 2012. Given that the other G7 Central Banks probably won’t hike for a couple more quarters – and even then, rate hikes will be gradual and restrained – it’s only natural that yield seekers are flocking to the Aussie.

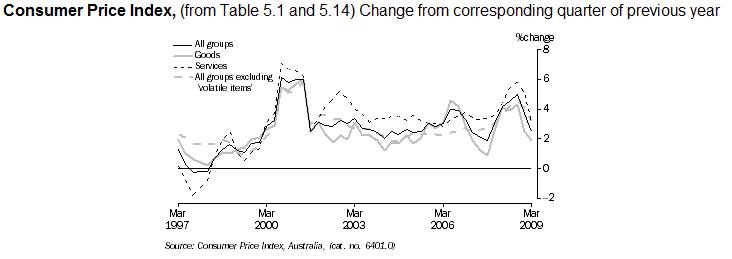

However, it seems possible that the markets have gotten ahead of themselves in presuming an airtight case for further rate hikes. While Australian inflation is somewhat high (2.7%), it has actually moderated slightly over the last six months. In addition, the rising Australian Dollar will help to mitigate inflation and hence make it less likely that the Reserve Bank of Australia (RBA) will hike rates. (How ironic that the markets’ bet on higher interest rates in Australia actually makes it less likely that those rate hikes will actually take place!). Moreover, the domestic Australian economy isn’t performing as well as some people think. It is true that an investment boom in mining and a surge in commodities prices have provided an economic windfall. On the other hand, the strong Aussie has undermined strength in the manufacturing sector, the housing market is poised for correction, and the summer flooding will crimp at least .5% from 2011 GDP.

Moreover, the domestic Australian economy isn’t performing as well as some people think. It is true that an investment boom in mining and a surge in commodities prices have provided an economic windfall. On the other hand, the strong Aussie has undermined strength in the manufacturing sector, the housing market is poised for correction, and the summer flooding will crimp at least .5% from 2011 GDP.

In fact, not only is it not guaranteed that the RBA will hike rates, but some analyststhink it’s possible that the RBA will cut its benchmark cash rate before the end of the year. At the very least, analysts need to double check their assumptions and re-jigger their interest rates models. Given that the Australian Dollar is primarily being supported by expectations for higher interest rates, that also means that investors to scale back their forecasts for the Australian Dollar.

Personally, I think that a bubble is beginning to form in currency markets, at least in certain corners of it. Due to commodity prices and relatively high interest rates, the Aussie is certainly one of the more attractive major currencies at the moment. At that same time, that it has risen so fast in the last few years – and especially in the last few weeks – strikes me as fundamentally illogical. At this point, its rise has become self-fulfilling; investors want it to rise, and so it does. At this point, there are two possibilities. Either the markets will wait for fundamentals to catch up with the Aussie, and it will hover around parity or appreciate slightly, orinvestors will recognize that it has appreciated too much too fast, and its correction will become one of the major events in forex markets in 2012.

At this point, there are two possibilities. Either the markets will wait for fundamentals to catch up with the Aussie, and it will hover around parity or appreciate slightly, orinvestors will recognize that it has appreciated too much too fast, and its correction will become one of the major events in forex markets in 2012.

التسميات:

Australian Dollar 2012

Aussie is Breaking Away from Kiwi

Aussie is Breaking Away from Kiwi

The correlation between the Australian Dollar and New Zealand Dollar is among the strongest that exists between two currencies. Given their regional bond and similar dependence on commodities to drive economic growth, perhaps this is no wonder. Over the last year, however, the Aussie has slowly broken away from the Kiwi. While the correlation between the two remains strong, the emergence of distinct narratives has given rise to a clear chasm, which can be seen in the chart below. Given that the NZD is evidently among the most overvalued currencies in the world, does that mean the same can be said about the AUD?

Alas, geographic proximity aside, the two economies have very little in common. Australia is rich in coal, precious metals and other natural resources , while New Zealand produces and export primarily agricultural products. Granted, the prices for both types of commodities have exploded over the last decade (and especially the last year), but let’s be clear about the distinction. This has enabled both economies to achieve trade surpluses, but oddly current account deficits. Australia’s economy is projected to grow by more than 4% in 2011, compared to 2% in New Zealand. Australia’s benchmark interest rate is also higher, its capital markets are deeper, and the supply of its currency necessarily exceeds that of New Zealand.

Alas, geographic proximity aside, the two economies have very little in common. Australia is rich in coal, precious metals and other natural resources , while New Zealand produces and export primarily agricultural products. Granted, the prices for both types of commodities have exploded over the last decade (and especially the last year), but let’s be clear about the distinction. This has enabled both economies to achieve trade surpluses, but oddly current account deficits. Australia’s economy is projected to grow by more than 4% in 2011, compared to 2% in New Zealand. Australia’s benchmark interest rate is also higher, its capital markets are deeper, and the supply of its currency necessarily exceeds that of New Zealand.

Taken at face value, then, it would seem commonsensical that the Aussie should rise both against the Kiwi and the US Dollar. Indeed, it recently touched an all-time high against the latter, and is now firmly entrenched above parity. On a trade-weighted basis, it has been among the world’s best performers over the last two years. In fact, some are wondering (myself included), whether the Australian Dollar might have risen too much for its own good. According to OECD valuations based onpurchasing power parity (ppp), the Aussie is now 38% overvalued against the dollar, behind only the Swiss Franc and Norwegian Krone. In fact, exporters of non-commodity products (i.e. those whose customers are actually price-sensitive) have warned of mounting competitive pressures, declining sales, and inevitable price cuts. In other words, the portion of the Australian economy that doesn’t deal in commodities is actually in quite fragile shape. Given that China’s economy is projected to slow over the next two years and that booming investment in Australia’s mining sector should boost output, the commodity sector of the economy might soon face similar pressures.

In fact, some are wondering (myself included), whether the Australian Dollar might have risen too much for its own good. According to OECD valuations based onpurchasing power parity (ppp), the Aussie is now 38% overvalued against the dollar, behind only the Swiss Franc and Norwegian Krone. In fact, exporters of non-commodity products (i.e. those whose customers are actually price-sensitive) have warned of mounting competitive pressures, declining sales, and inevitable price cuts. In other words, the portion of the Australian economy that doesn’t deal in commodities is actually in quite fragile shape. Given that China’s economy is projected to slow over the next two years and that booming investment in Australia’s mining sector should boost output, the commodity sector of the economy might soon face similar pressures.

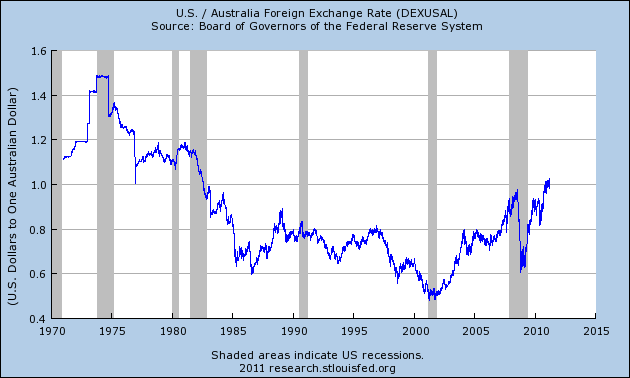

For that reason, the Reserve Bank of Australia (RBA) has avoided raising its benchmark interest rate is fast as some analysts had expected, and inflation hawks had hoped. There is a chance for a 25 basis point hike as soon as June – bring the base rate to an even 5% – but the RBA’s own statements indicate that it probably won’t be until June and July. Regardless of when the RBA tightens, Australian interest rate differentials will remain strong for the foreseeable future, and likely continue to attract speculative inflows for as long as risk appetite remains strong. So why does the Australian dollar continue to rise? It might have something to do with gold. As you can see from the chart above, the correlation between the Aussie and gold prices is almost just as strong as the relationship between the Aussie and the Kiwi. Given that Australia is the world’s second largest gold exporter, it is perhaps unsurprising that investors would see rising gold prices as a reason for buying the Australian dollar. However, it seems equally possible that demand for both is being driven by the pickup in risk appetite. While some gold buyers might counter that gold is best suited for those who are averse to risk (i.e. afraid that the financial system will collapse), the performance of gold over the last five years suggests that in fact the opposite is true. When risk appetite is high, speculators have bought gold and the Australian dollar (among other assets).